Here’s the story of how one business owner’s buy-sell agreement understated his company’s value by a factor of 10, and what you need to know for your own business value and exit planning.

Recent Posts

Recently we had a client go through a thorough and well-prepared process to sell his company. About 300 potential buyers were contacted — a mix of strategic and financial players. Here’s the preliminary breakdown:

High-performing employees are the most valuable asset in most companies. Customers, products, technology, inventory, and most other assets come and go.

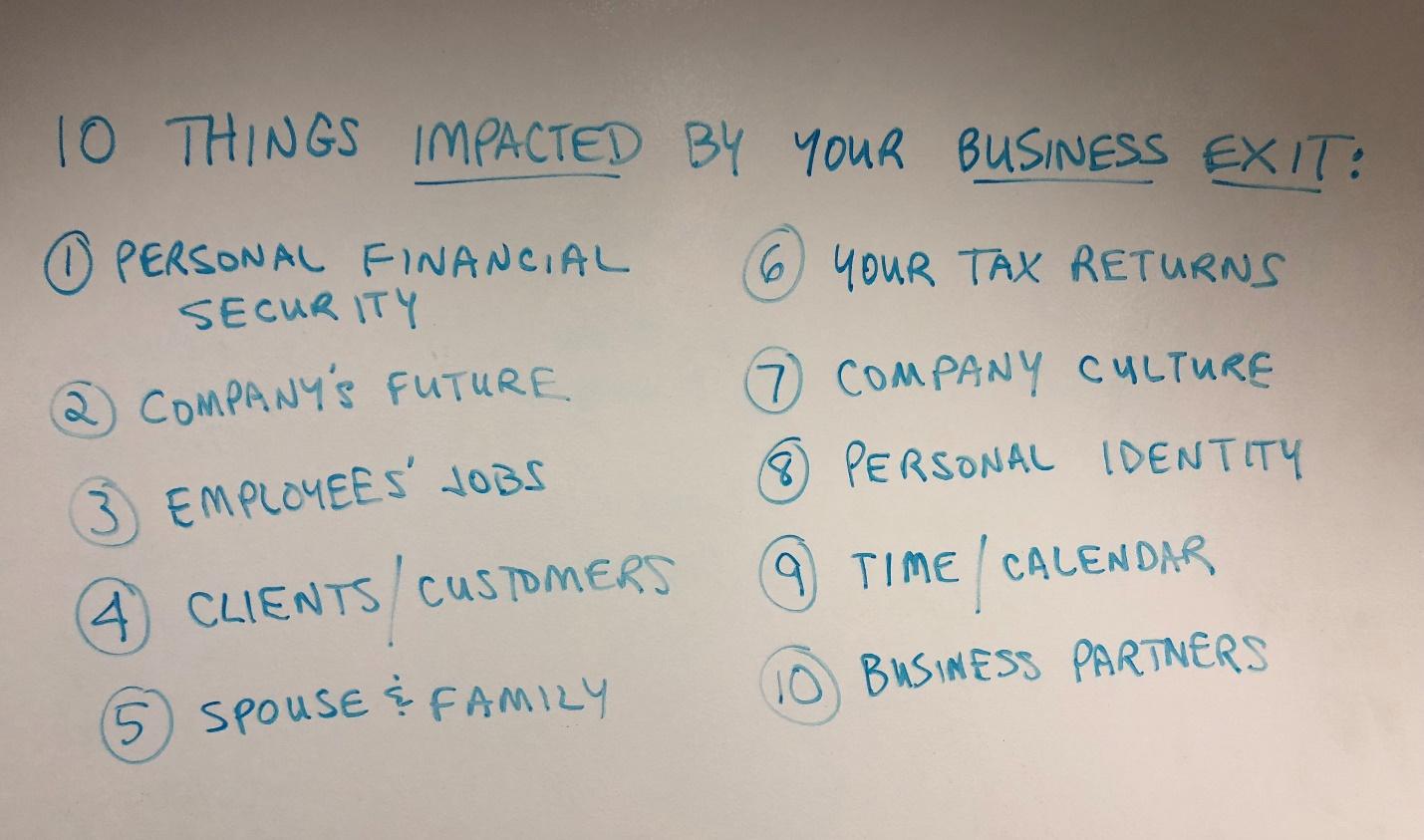

Research survey after survey shows that most owners of small to mid-sized companies lack an exit plan. My nearly 30 years of experience backs this up; practically every day, I see business owners working incredibly hard to grow their companies but giving little thought to their future exit and doing even less to prepare for this inevitable event.

A recent technical change in the Small Business Administration’s (SBA) lending policies could make it easier to finance buying out a business partner. Prior to this change, borrowing money to buy out a partner through an SBA loan guarantee program could often be difficult or impossible.